Financial technology (FinTech) is on the rise. One article reported that Malaysia's fintech sector expanded by 27% in 2021, with 294 financial technology (FinTech) app development.

Investment apps are changing how investment management works and catering to younger investors with different goals and preferences than older generations.

If you are thinking about creating a custom investment app, there are a few things you need to keep in mind. First, you need to understand the needs of your target audience. What are their goals? What are their investment strategies?

Once you know their needs, you can start designing an app that meets them.

Hence, you must understand how to design effective bespoke investment apps.

What is the Investment App?

Investment app is a mobile app development that allows users to manage their investments from their smartphones. These apps can track users’ portfolios, and buy and sell stocks.

With investment apps, users can easily set up an account and start investing with as little as $1. Most investment apps offer educational resources and tools that can help users learn more about investing and make informed decisions about their portfolios.

Key Benefits of Investment Apps

Here are several benefits of using investment apps include:

- Convenience: Manage users’ investments from anywhere, at any time.

- Affordability: Investment apps have low fees, making them a more affordable option than traditional brokerage accounts.

- Education: Offer educational resources and tools that can help users learn more about investing.

- Diversification: Allows users to invest in a variety of different assets, including stocks, bonds, and ETFs.

- Transparency: Provide users with real-time information about their investments, including prices, performance, and fees.

Some of the most popular investing applications such as Acorns, Robinhood, Wealthfront, Betterment, and Fidelity.

Differences between Investment Apps and Investment Management

Investment apps and investment management are two different ways to invest your money.

As previously stated, investment apps charge low fees and are available for small investments. However, it may not offer personalised advice or investment management services.

Investment management is a more hands-on approach to investing. A professional investment manager will create a portfolio of investments based on your individual needs and goals. They will also monitor your portfolio and make adjustments as needed.

Yet, investment management typically costs more than investment apps, but it can offer the peace of mind that comes with knowing that your investments are being managed by a professional.

Here are some of the key differences between investment apps and investment management:

1. Cost

Investment apps have lower fees than investment management. Before making any investment decisions through investment apps, users should carefully consider their investment goals and risk tolerance, despite the lower fees.

2. Convenience

Since users can manage their assets from their phones, investing apps are more handy than investment management.

3. Personalisation

Investment management offers more personalization than investment apps, as a professional investment manager will create a portfolio of investments based on your individual needs and goals.

4. Service

Investment management provides a higher level of service than investment apps since they will monitor users’ accounts and make changes as needed.

Create Investment App Development

The process of developing a custom investment app can be divided into the following steps:

1. Conceptualise

First, what specific features will it have? Will it be a simple tool or a more complex investment app? What problem is your app development to solve?

Secondly, it is important to think about your target audience. Who do you hope to target with your app? What are their investment goals and strategies?

When creating investment apps, consider the app's vision and mission. What is the app's ultimate goal, and how will it help users achieve their investment objectives?

Answering those questions will help you develop a unique and comprehensive vision for your app.

2. Choose the Development Platform

Selecting the ideal development platform is a critical step in creating an investment app. Your decision will significantly impact the app's performance and user experience. Three primary options are available:

- iOS: Offers a sleek, secure experience for Apple users, instilling trust in financial activities.

- Android: Provides flexibility for diverse devices, reaching a broader audience.

- React Native: Delivers cross-platform efficiency, saving time and ensuring a smooth user experience.

3. Design

Creating wireframes and mockups are essential tools for visualising the user interface and user experience of your investment app.

Wireframes are low-fidelity sketches that help you map out the basic structure of your app, while mockups are higher-fidelity visuals that show how the app will look and feel.

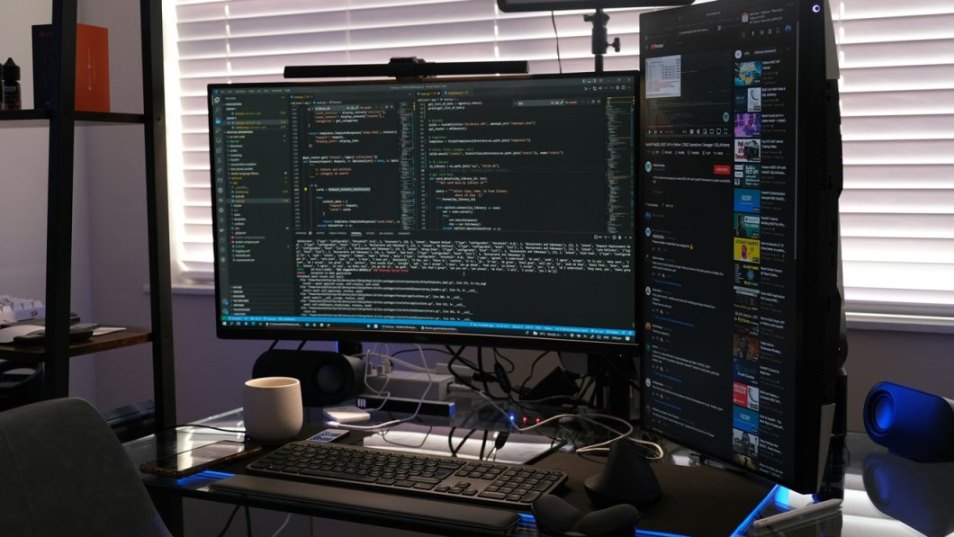

4. Develop

Once you've designed the user interface, you can start developing the app. Use a programming language and development framework to create the app's code. It involves coding the app's functionality and integrating it with any external APIs.

5. A/B Testing

After you have developed your investment app, you will need to test it to ensure that it is bug-free and user-friendly. Testing can be done by running unit tests, integration tests, usability testing, and user acceptance tests.

You should also test the app on different devices and browsers to make sure that it works on all platforms. Getting feedback from users to see how they like the app and what features they would like to add.

Wrapping Up

Financial technology (FinTech) such as investment apps is a viable option for those who are seeking a low-cost, convenient, and personalised means of investing. At the same time, investment management may be a more suitable option for those who are seeking a higher level of services.

If you are thinking about developing an investment app, be sure to carefully consider your target audience, app vision, and development platform. With careful planning and execution, you can create a successful investment app that helps users achieve their financial goals.

Get a consultation with VirtualSpirit experts to discuss the best way to develop your investment app. Discuss your project here to get started.