Do you find it challenging to keep track of expenses and stick to a budget? Now, Fintech applications have arrived as a solution. App development forms the foundation of the fintech ecosystem.

Fintech companies leverage cutting-edge technology with financial expertise to provide users with comprehensive budgeting and expense-tracking tools.

Based on a report from Deloitte, in 2017, global Fintech industry revenues reached $90.5 billion. Since then, that figure has now grown to over 100%.

Not only that, Statista also states that in 2021, there will be more than 10,000 fintech startups registered in the United States and more than 26,000 worldwide.

Why is the Fintech industry growing so fast and popular among the public? According to NerdWallet and Forbes, the 9 million unbanked households in the US pay an average of $200 to $500 in annual fees for financial services like check cashing. Fintech helps people avoid these fees through digital direct deposit.

Fintech apps are designed to streamline your financial management, making it easier than ever before. Whether you're a seasoned investor or someone just starting with budgeting, these money management apps are indispensable.

Let's explore the best budgeting and expense-tracking apps and their benefits.

Budgeting and Expense Tracking Features in Fintech Apps

Fintech apps have revolutionised the way we handle our finances. They offer an array of features that simplify budgeting and expense tracking. Here are some of the key features you can find in these apps:

1. Personalised Budget Creation

The best budgeting and expense-tracking apps can create personalised budgets. These apps analyse your spending habits and income to generate customised funding tailored to your financial goals.

2. Expense Categorization

Effortlessly categorise your expenses with fintech apps. They automatically sort your transactions into categories like groceries, utilities, and entertainment, clearly showing where your money is going.

3. Real-time Transaction Tracking

Stay updated with your finances in real-time. These apps track your transactions as they occur, ensuring you're always aware of your account balances and expenditures.

4. Goal Setting and Tracking

Set financial goals and track your progress with ease. Fintech apps allow you to define your objectives, whether saving for a vacation or paying off debt, and monitor your journey towards achieving them.

5. Bill Payment Reminders

Bill payment reminders send timely notifications, typically via email, text message, or app notification. These reminders inform you of upcoming due dates well in advance, allowing you to prepare and ensure sufficient funds are available.

6. Financial Insights

Gain valuable insights into your financial behaviour. Fintech apps provide charts and reports illustrating your spending patterns, empowering you to make informed decisions.

7. Security Measures

A report found that young people trust fintech companies more than banks, with 51% of 18 to 24-year-olds and 49% of 25 to 34-year-olds trusting fintech. Rest assured, your financial data is safe with fintech apps. They employ robust security protocols to protect your sensitive information, including encryption and multi-factor authentication.

8. Multi-platform Accessibility

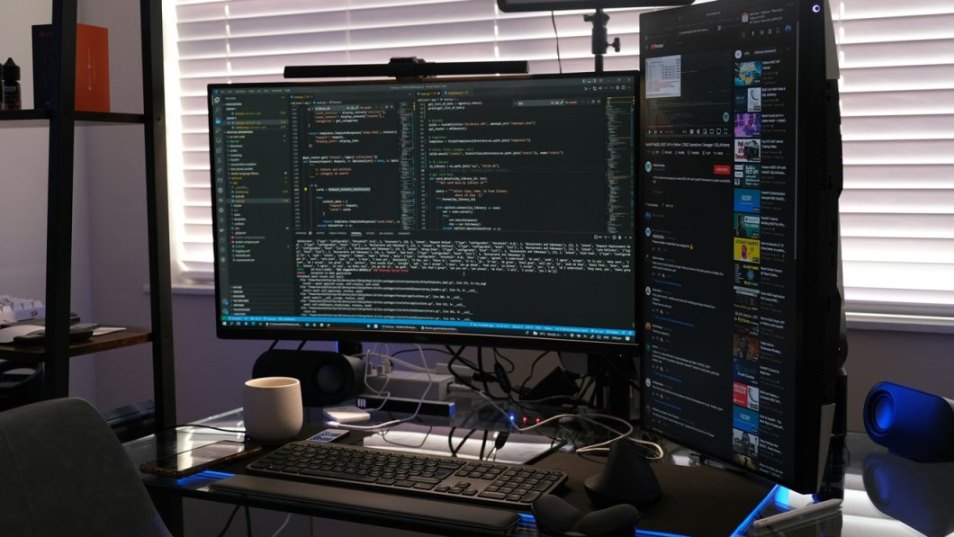

Multi-platform accessibility, as the name suggests, refers to the ability of fintech apps to function seamlessly across various devices and platforms.

Access your financial data from anywhere with cloud-based fintech apps. It eliminates the constraints of being tied to a single device or operating system, allowing users to manage their finances anytime and anywhere.

9. Investment Integration

Some fintech apps go beyond budgeting and offer investment tracking. Monitor your stock portfolios and retirement accounts within the same app, simplifying your financial management.

10. User-friendly Interfaces

These apps are designed with user-friendliness in mind. Their intuitive interfaces make financial management a breeze, even for those new to budgeting.

The Benefits of Using Budgeting and Expense Tracking Apps

Now that we've explored the features let's delve into the numerous benefits of using budgeting and expense-tracking apps:

- Financial Clarity: Budgeting apps provide a crystal-clear view of your financial situation. You can see exactly where your money is going, making it easier to make necessary adjustments.

- Improved Saving Habits: When you can visualise your financial goals and track your progress, saving money becomes more achievable. Fintech apps motivate you to keep by showing you the bigger picture.

- Reduced Financial Stress: Financial stress can take a toll on your mental health. Budgeting apps help alleviate this stress by providing a sense of control over your finances.

- Better Decision-Making: You can make informed decisions about your financial future with insights into your spending habits. This might involve cutting unnecessary expenses or investing more wisely.

- Enhanced Accountability: Fintech apps hold you accountable for your financial choices. When you see where your money is going, you're less likely to overspend or make impulsive purchases.

- Time Savings: Gone are the days of manual expense tracking. These apps save you time by automating the process, allowing you to focus on more critical aspects of your life. According to Unit4, with the right software, businesses can reduce the annual budget creation process from several days to just minutes.

Wrapping Up

The budgeting and expense tracking features in FinTech apps are game changers for anyone who wants to take control of their finances.

With personalised budgets, real-time tracking, and many benefits, this app empowers you to achieve your financial goals. Whether you're new to budgeting or already experienced, it's time to welcome the future of financial management with fintech applications.